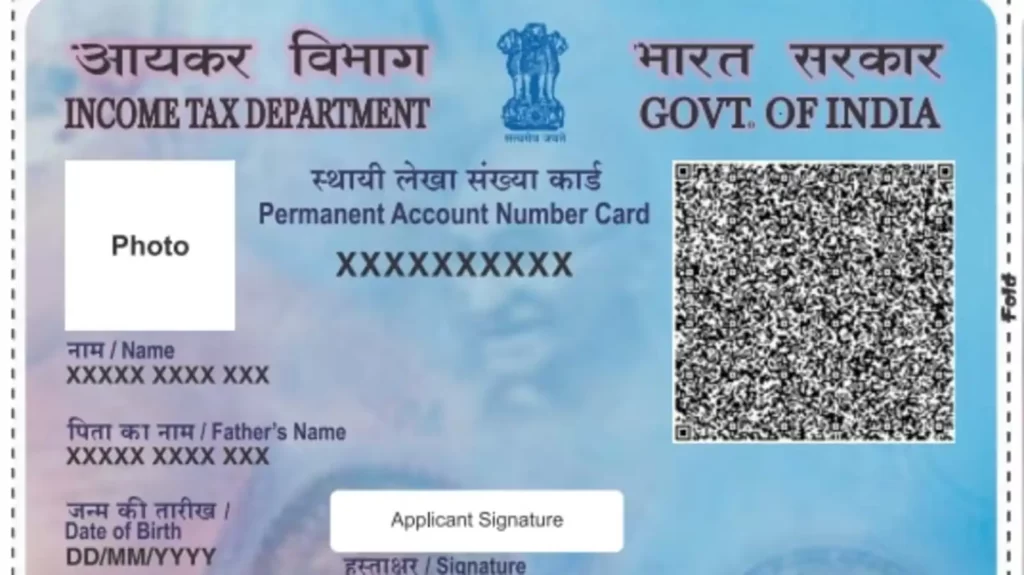

PAN Card

What is PAN Card?

A PAN (Permanent Account Number) card is a unique ten-digit alphanumeric identifier issued by the Indian Income Tax Department under the supervision of the Central Board of Direct Taxes. It acts as an essential identity proof for various financial transactions such as opening a bank account, buying or selling property, and filing income tax returns.

To apply for a PAN card, one can register online through the NSDL or UTIITSL website or visit a nearby PAN service centre. The applicant must fill the PAN application form, submit relevant documents such as Aadhaar card, identity proof, proof of address, and pay the applicable fees.

After verification of the documents and successful processing of the application, the applicant will receive the PAN card through post within 15-20 working days. The PAN card registration is mandatory for Indian citizens, foreign nationals, and entities carrying out any financial transactions in India.

Benefits of PAN Card Registration

Having a PAN card is not mandatory, but it is highly recommended for anyone who earns an income, pays taxes and conducts business transactions. The benefits of PAN card registration include easier access to loans, credit cards and other financial services, simplified tax filing and compliance, reduced chances of tax evasion and fraud, increased credibility and trust among customers and business partners, and eligibility for government subsidies and welfare schemes. A PAN card is also a valid proof of identity and address, which can be used for various official purposes, such as opening a bank account, applying for a passport or visa, buying or selling property, and so on. Therefore, it is advisable to apply for a PAN card as soon as possible and keep it updated and valid at all times.

Looking for Professional Tax Consulting Services in Pune?

Get expert advice and assistance in various aspects of tax management, including compliance, planning, and strategies